In India, even in today’s fast digital age of Google Pay, PhonePe, and Paytm, the importance of a cheque book has not reduced. Whether it is for office payments, school fees, rent, business transactions, or official bank work, a cheque is still considered one of the most trusted and formal payment methods.

But many people still get confused when the bank asks them to submit a written request. That is where a Cheque Book Issue Application in Hindi becomes important.

This detailed guide is specially written to help you understand what a cheque book application is, why it is needed, how to write it correctly, and ready-to-use Hindi application formats for 7 common situations. This article is designed in a simple, conversational, and practical way, so you can directly use it for your blog or personal needs.

What is a Cheque Book and Why is it Important?

A cheque book is a small booklet issued by a bank that contains multiple cheque leaves. Each cheque leaf is linked to your bank account and allows you to make formal payments without using cash.

Banks like State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, and Punjab National Bank still issue cheque books because cheques are:

- Legally valid payment instruments

- Accepted by offices, schools, and businesses

- Useful for high-value and official transactions

- Traceable and record-friendly

A cheque book usually contains:

- Account holder’s name

- Account number

- IFSC code

- Bank branch details

Whenever you need a new cheque book, you must submit a cheque book issue application so the bank can verify your identity and keep proper records.

Why Do Banks Ask for a Cheque Book Issue Application?

Banks never issue a cheque book casually. A written application helps them:

- Confirm that the request is coming from the real account holder

- Understand the reason (new account, lost book, finished leaves, etc.)

- Maintain internal documentation

- Prevent misuse and fraud

You may need to write this application when:

- You opened a new bank account

- Your old cheque book is finished

- Your cheque book is lost or stolen

- Your cheque book is damaged

- You need it for a business account

- You need it urgently

- Your address has changed

What Information Must Be Included in a Cheque Book Application?

Before looking at the formats, it is very important to understand the key elements of a correct application.

Basic details that must always be present:

- Bank name and branch

- Date

- Subject line

- Account holder’s name

- Account number

- Reason for request

- Polite request sentence

- Mobile number

- Signature

Language style should be:

- Formal

- Respectful

- Clear and short

- Error-free

Cheque Book Issue Application Format (General Structure)

| Part | What to write |

|---|---|

| Bank Address | Branch manager, bank name, branch |

| Date | Application date |

| Subject | Short and clear reason |

| Body | Introduction + account details + request |

| Closing | Thank you + signature |

A good format makes your application look professional and increases the chance of quick processing.

7 Cheque Book Issue Application in Hindi (Ready-to-Use Formats)

Below are the most commonly required cheque book applications in daily life. Each one is written in simple formal Hindi, so students, employees, and business owners can use them easily.

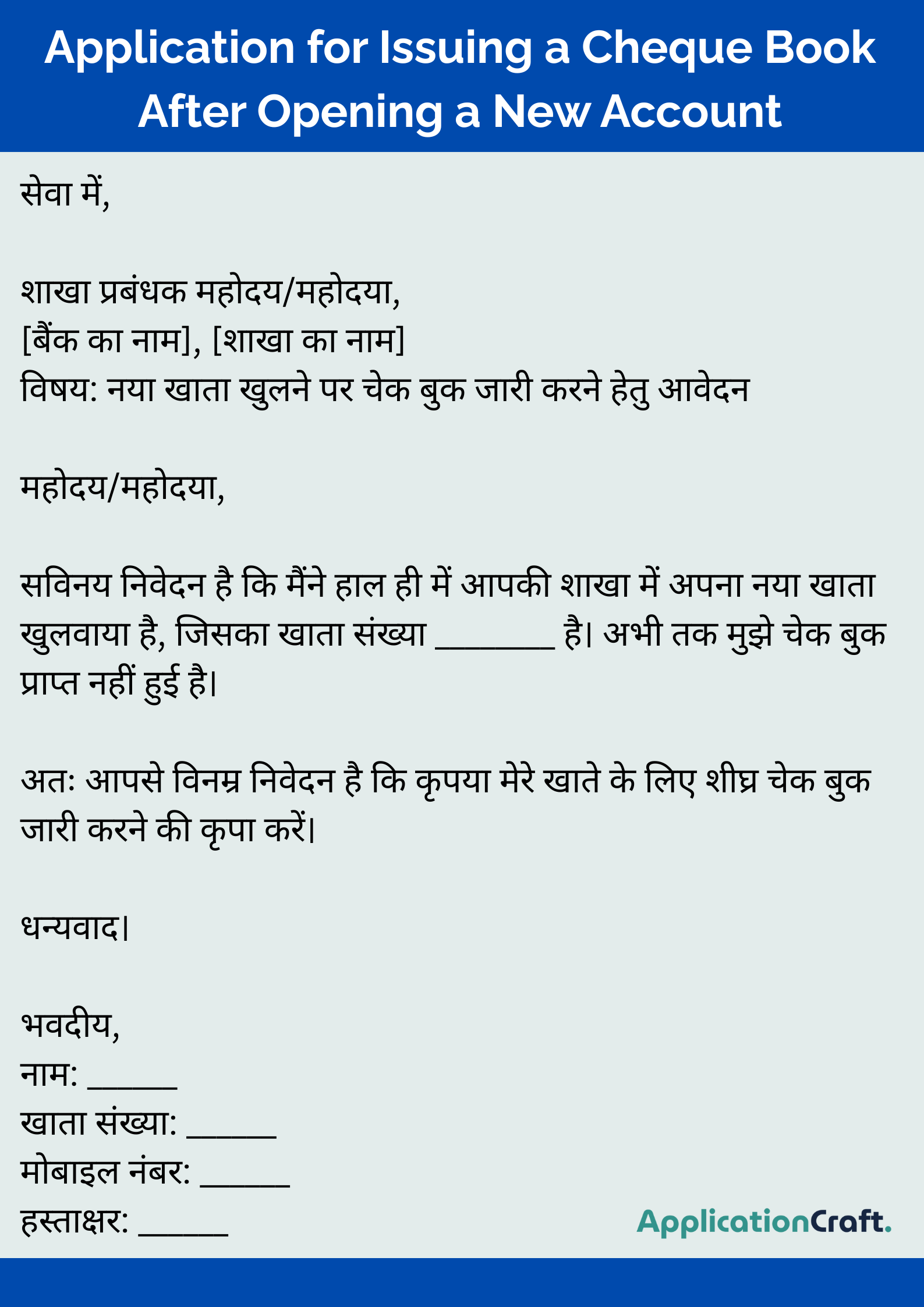

1. Application for Issuing a Cheque Book After Opening a New Account

When is this used?

When you have recently opened a savings or current account and the bank has not yet issued your cheque book.

Example Application

सेवा में,

शाखा प्रबंधक महोदय/महोदया,

[बैंक का नाम], [शाखा का नाम]

विषय: नया खाता खुलने पर चेक बुक जारी करने हेतु आवेदन

महोदय/महोदया,

सविनय निवेदन है कि मैंने हाल ही में आपकी शाखा में अपना नया खाता खुलवाया है, जिसका खाता संख्या ________ है। अभी तक मुझे चेक बुक प्राप्त नहीं हुई है।

अतः आपसे विनम्र निवेदन है कि कृपया मेरे खाते के लिए शीघ्र चेक बुक जारी करने की कृपा करें।

धन्यवाद।

भवदीय,

नाम: ______

खाता संख्या: ______

मोबाइल नंबर: ______

हस्ताक्षर: ______

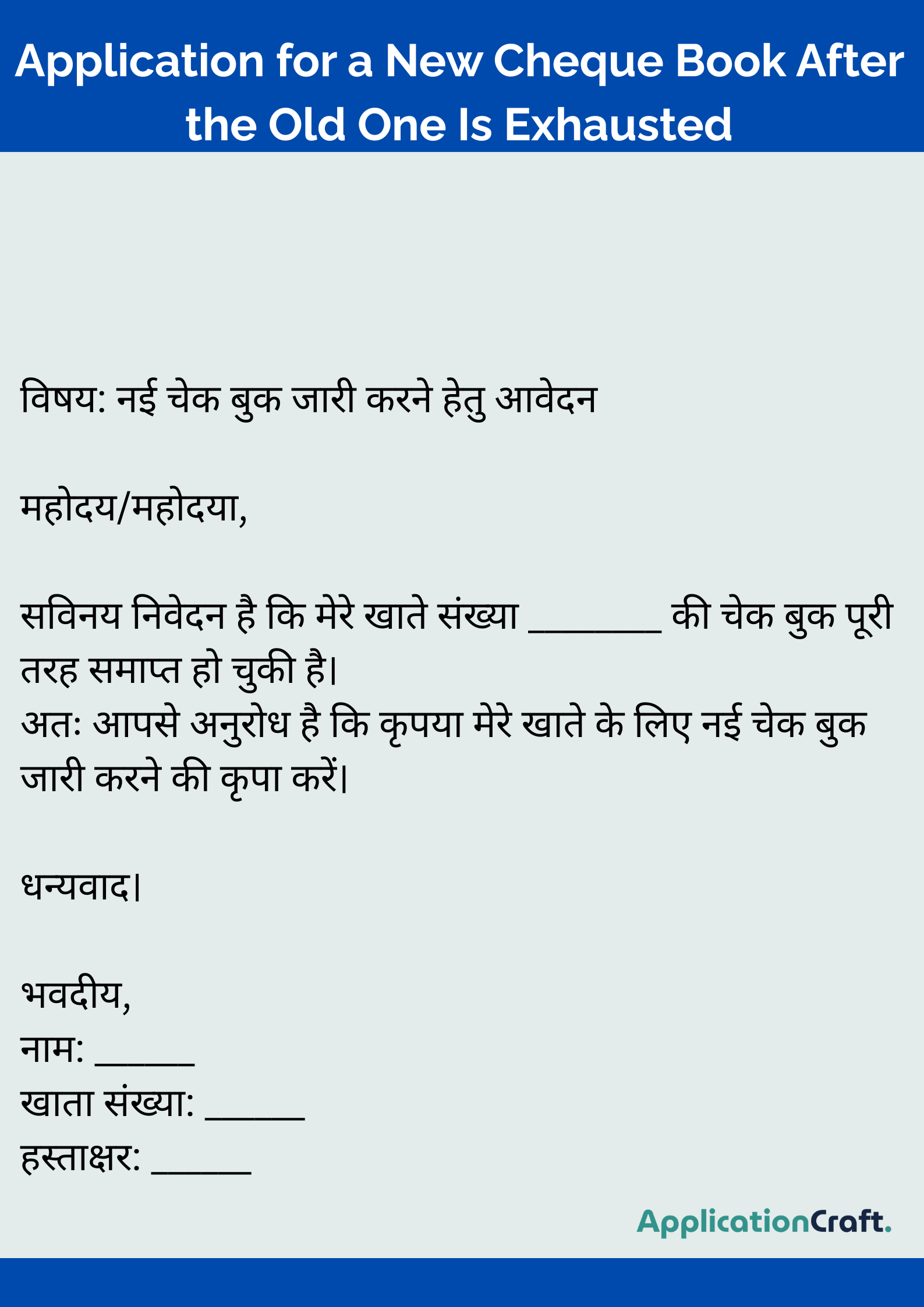

2. Application for a New Cheque Book After the Old One Is Exhausted

When is this used?

When all cheque leaves are used and you need a fresh cheque book.

Example Application

विषय: नई चेक बुक जारी करने हेतु आवेदन

महोदय/महोदया,

सविनय निवेदन है कि मेरे खाते संख्या ________ की चेक बुक पूरी तरह समाप्त हो चुकी है।

अतः आपसे अनुरोध है कि कृपया मेरे खाते के लिए नई चेक बुक जारी करने की कृपा करें।

सधन्यवाद।

भवदीय,

नाम: ______

खाता संख्या: ______

हस्ताक्षर: ______

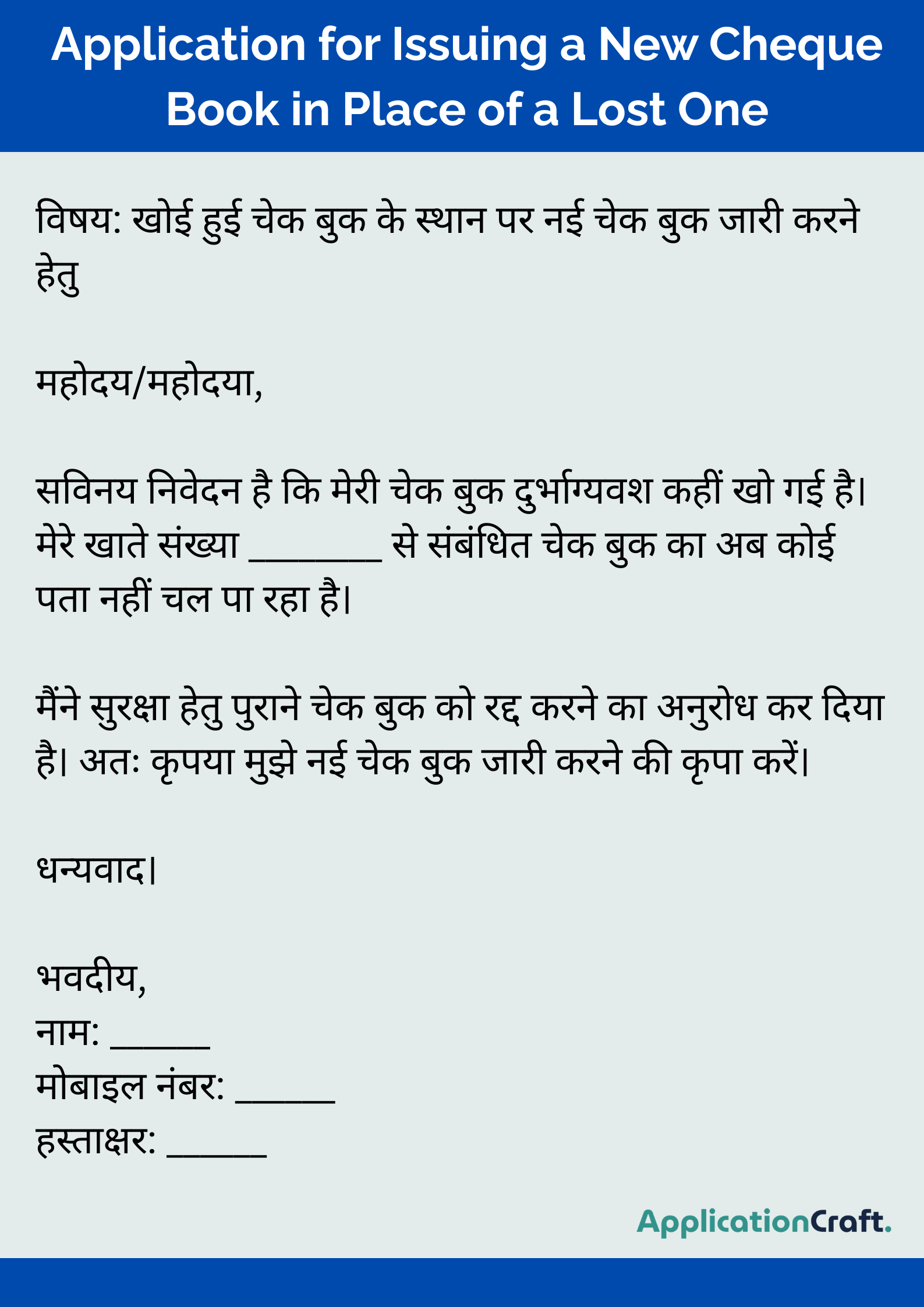

3. Application for Issuing a New Cheque Book in Place of a Lost One

When is this used?

If your cheque book is lost or stolen.

Example Application

विषय: खोई हुई चेक बुक के स्थान पर नई चेक बुक जारी करने हेतु

महोदय/महोदया,

सविनय निवेदन है कि मेरी चेक बुक दुर्भाग्यवश कहीं खो गई है। मेरे खाते संख्या ________ से संबंधित चेक बुक का अब कोई पता नहीं चल पा रहा है।

मैंने सुरक्षा हेतु पुराने चेक बुक को रद्द करने का अनुरोध कर दिया है। अतः कृपया मुझे नई चेक बुक जारी करने की कृपा करें।

धन्यवाद।

भवदीय,

नाम: ______

मोबाइल नंबर: ______

हस्ताक्षर: ______

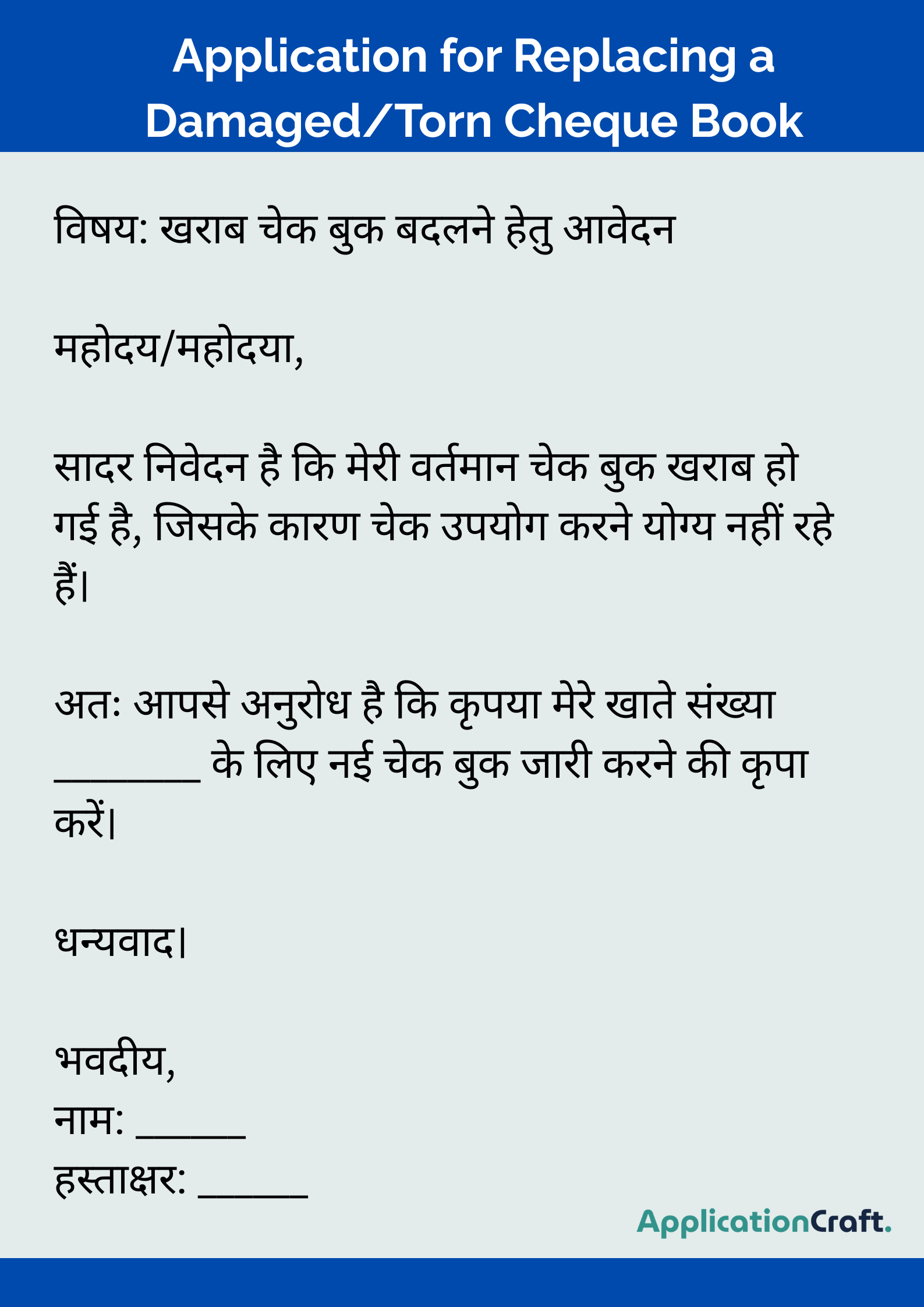

4. Application for Replacing a Damaged/Torn Cheque Book

When is this used?

If the cheque book is damaged, torn, or unreadable.

Example Application

विषय: खराब चेक बुक बदलने हेतु आवेदन

महोदय/महोदया,

सादर निवेदन है कि मेरी वर्तमान चेक बुक खराब हो गई है, जिसके कारण चेक उपयोग करने योग्य नहीं रहे हैं।

अतः आपसे अनुरोध है कि कृपया मेरे खाते संख्या ________ के लिए नई चेक बुक जारी करने की कृपा करें।

सधन्यवाद।

भवदीय,

नाम: ______

हस्ताक्षर: ______

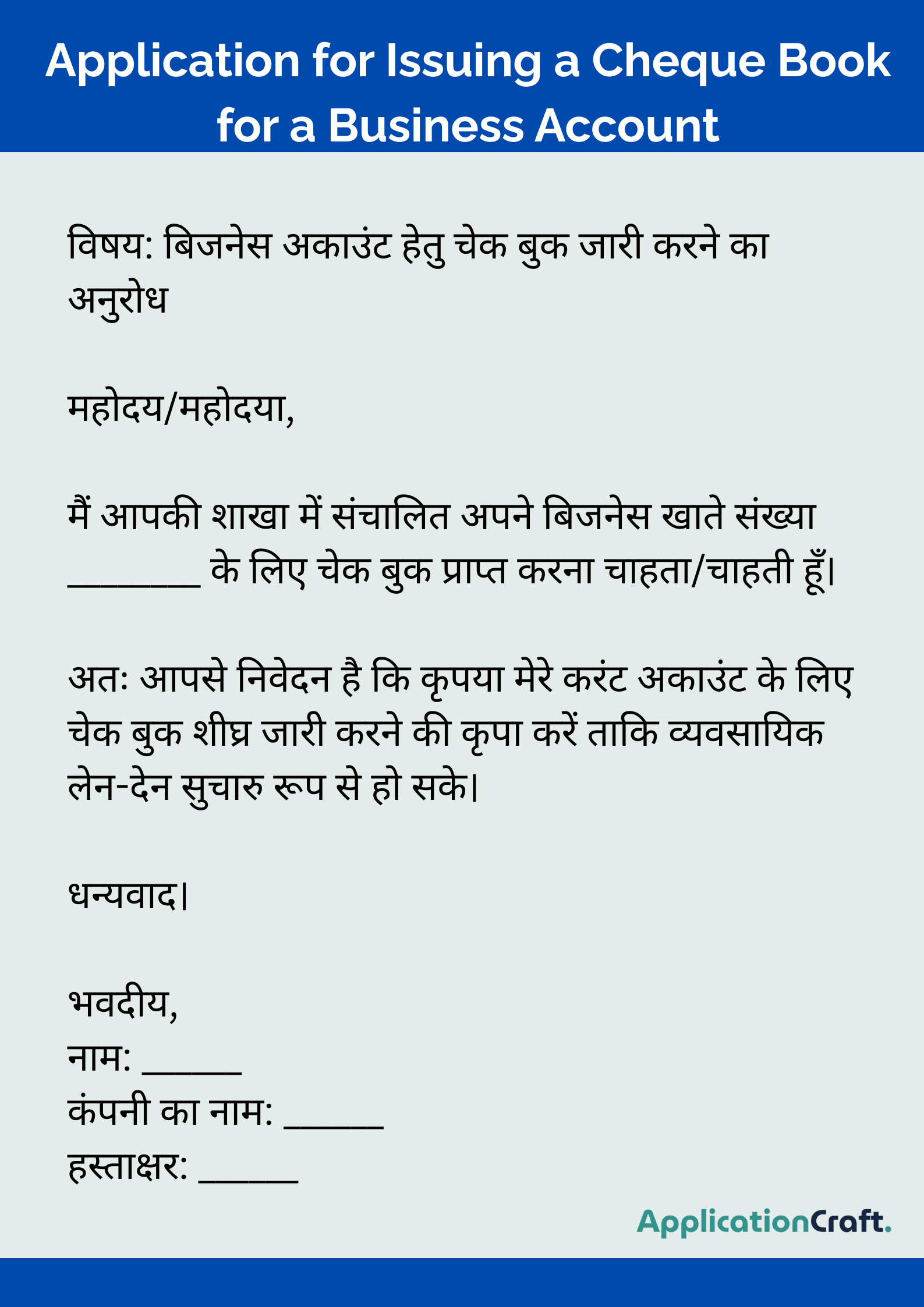

5. Application for Issuing a Cheque Book for a Business Account

When is this used?

For current accounts used in shops, companies, and startups.

Example Application

विषय: बिजनेस अकाउंट हेतु चेक बुक जारी करने का अनुरोध

महोदय/महोदया,

मैं आपकी शाखा में संचालित अपने बिजनेस खाते संख्या ________ के लिए चेक बुक प्राप्त करना चाहता/चाहती हूँ।

अतः आपसे निवेदन है कि कृपया मेरे करंट अकाउंट के लिए चेक बुक शीघ्र जारी करने की कृपा करें ताकि व्यवसायिक लेन-देन सुचारु रूप से हो सके।

धन्यवाद।

भवदीय,

नाम: ______

कंपनी का नाम: ______

हस्ताक्षर: ______

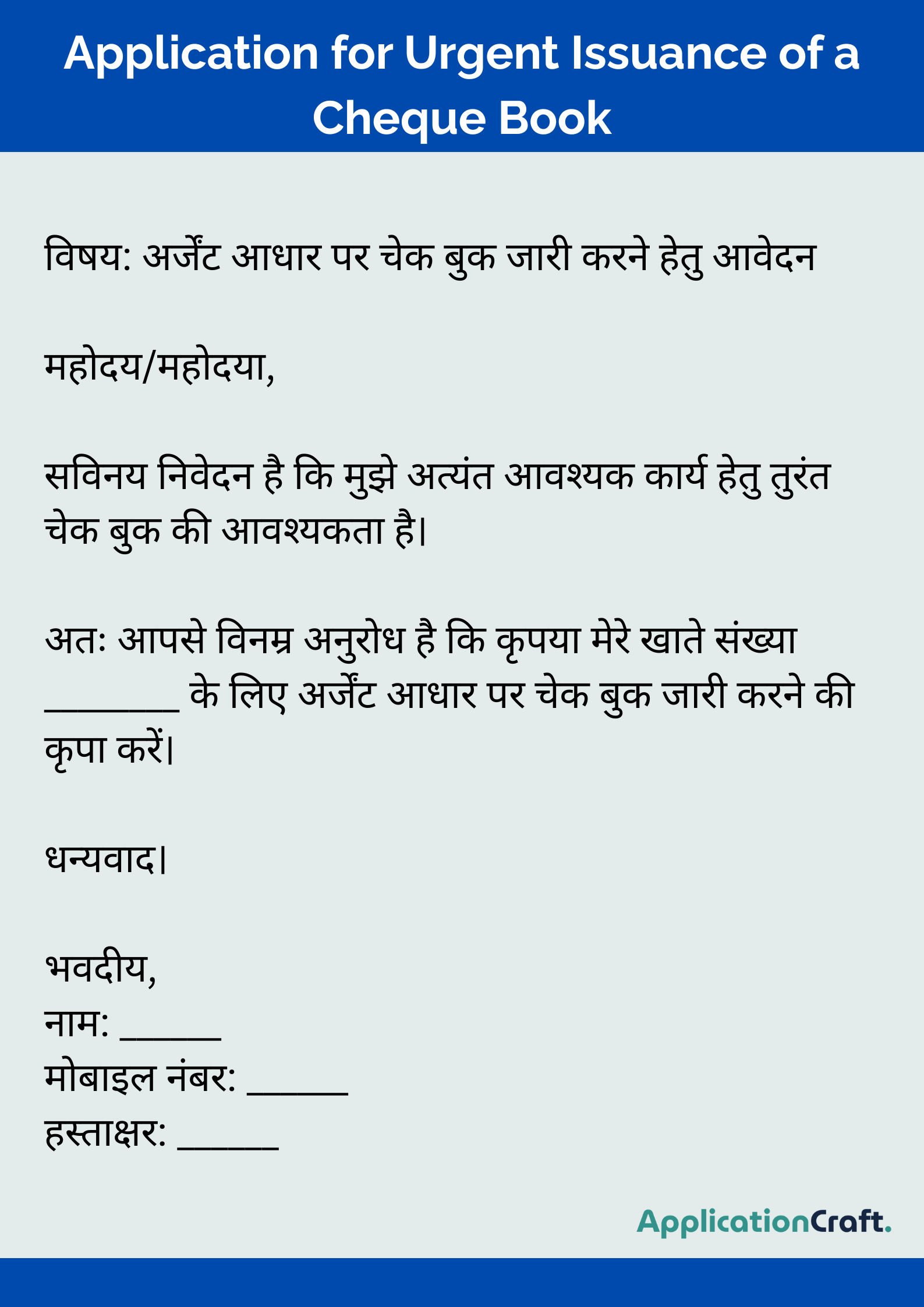

6. Application for Urgent Issuance of a Cheque Book

When is this used?

When cheque book is urgently needed for payments or official submission.

Example Application

विषय: अर्जेंट आधार पर चेक बुक जारी करने हेतु आवेदन

महोदय/महोदया,

सविनय निवेदन है कि मुझे अत्यंत आवश्यक कार्य हेतु तुरंत चेक बुक की आवश्यकता है।

अतः आपसे विनम्र अनुरोध है कि कृपया मेरे खाते संख्या ________ के लिए अर्जेंट आधार पर चेक बुक जारी करने की कृपा करें।

सधन्यवाद।

भवदीय,

नाम: ______

मोबाइल नंबर: ______

हस्ताक्षर: ______

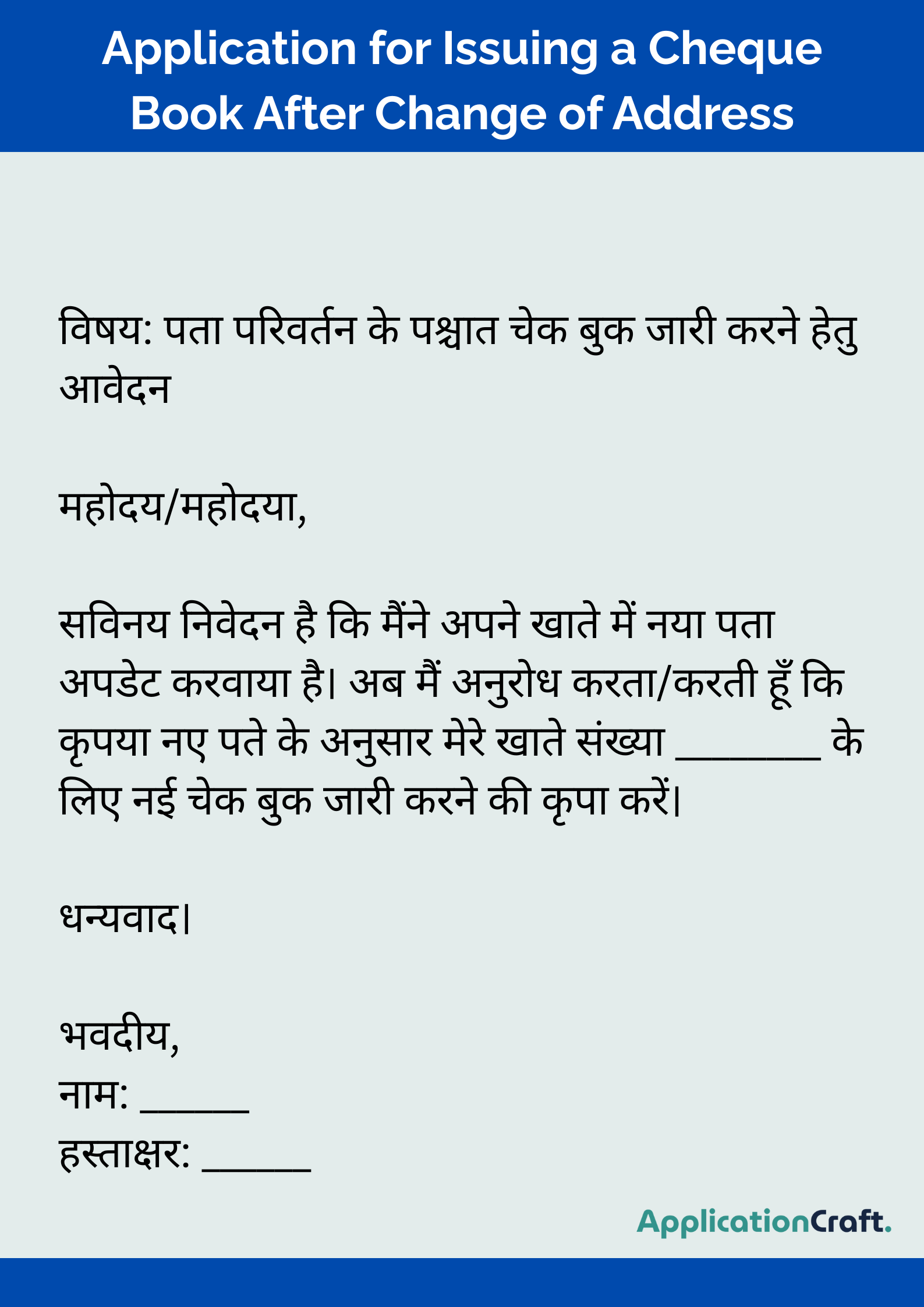

7. Application for Issuing a Cheque Book After Change of Address

When is this used?

When your address has changed and you want the new cheque book with updated records.

Example Application

विषय: पता परिवर्तन के पश्चात चेक बुक जारी करने हेतु आवेदन

महोदय/महोदया,

सविनय निवेदन है कि मैंने अपने खाते में नया पता अपडेट करवाया है। अब मैं अनुरोध करता/करती हूँ कि कृपया नए पते के अनुसार मेरे खाते संख्या ________ के लिए नई चेक बुक जारी करने की कृपा करें।

धन्यवाद।

भवदीय,

नाम: ______

हस्ताक्षर: ______

Ways to Apply for a Cheque Book

Apart from written applications, many modern banks also provide alternative methods:

- Visiting the bank branch

- Filling a cheque book request slip

- Using YONO SBI, HDFC Mobile Banking, ICICI iMobile

- ATM request option

- Calling customer care

Still, for record and formal purposes, a written cheque book issue application remains the most reliable method.

Important Tips While Writing a Cheque Book Application

- Always write correct account number

- Signature must match bank records

- Never overwrite important details

- Keep a polite tone

- Attach ID proof if asked

- Inform bank immediately in case of lost cheque book

Frequently Asked Questions (FAQs)

Q1. How many days does it take to get a cheque book?

Usually 3 to 7 working days depending on the bank.

Q2. Is a cheque book free?

Most banks provide limited free cheque books every year.

Q3. What to do if cheque book is lost?

Immediately inform the bank and submit a written application.

Q4. Can students apply for cheque books?

Yes, if their account supports cheque facility.

Q5. Can I apply online?

Yes, through official mobile banking apps of banks like SBI, HDFC, and Axis Bank.