Welcome to my in-depth guide on 7 Bank Statement Application Hindi! If you’re someone who often deals with banks for loans, visas, scholarships, or business purposes, you know how crucial a bank statement is. In this article, I’ll walk you through everything you need to know about writing a bank statement application in Hindi, including real-world examples, practical tips, and easy-to-understand explanations. Whether you’re a student, business owner, or someone managing personal finances, this guide is crafted to help you write effective applications and get your bank statement without any hassle.

Also Read:

Bank Account Transfer Application in Hindi

Essential Applications for Police Station in Hindi

Medical Leave Application in Hindi

The Importance of a Bank Statement Application

A bank statement application is a formal request you submit to your bank to obtain a record of your account transactions for a specific period. This document is vital for a variety of reasons, including applying for loans, filing income tax returns, securing a visa, or even tracking your financial health. In India, especially with banks like State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda, the process is straightforward but requires a properly drafted application.

When and Why Do You Need a Bank Statement?

Here are some common scenarios where a bank statement is required:

- Loan applications (home, personal, vehicle loans)

- Income tax return filing

- Visa or passport applications

- Scholarship or educational admissions

- Business and current account verifications

- Personal financial record-keeping

- Proof of income for government schemes

Essential Elements of a Bank Statement Application

Main Components of the Application Letter

A well-structured bank statement application should include all the key details to ensure your request is processed quickly. Here’s what you must mention:

| Element | Description |

|---|---|

| Recipient Details | Address the letter to the Branch Manager, mention the bank name and branch |

| Subject | Clearly state the purpose, e.g., “Application for Bank Statement” |

| Applicant Details | Your name, account number, address, contact number |

| Period Required | Specify the date range for the statement |

| Reason | State why you need the statement (loan, visa, etc.) |

| ID Proof | Attach a copy if required (Aadhaar, PAN, etc.) |

| Date & Signature | Date of application and your signature |

Tips for Format and Language

- Use polite and formal language.

- Ensure all personal and account details are accurate.

- Clearly mention the reason and period for the statement.

- Attach supporting documents like ID proof when necessary.

- Sign the application and include the date for authenticity.

7 Types of Bank Statement Applications (Hindi Examples)

Now, let’s break down seven practical scenarios where you might need a bank statement application. For each, I’ll provide a sample format in Hindi and explain its usage.

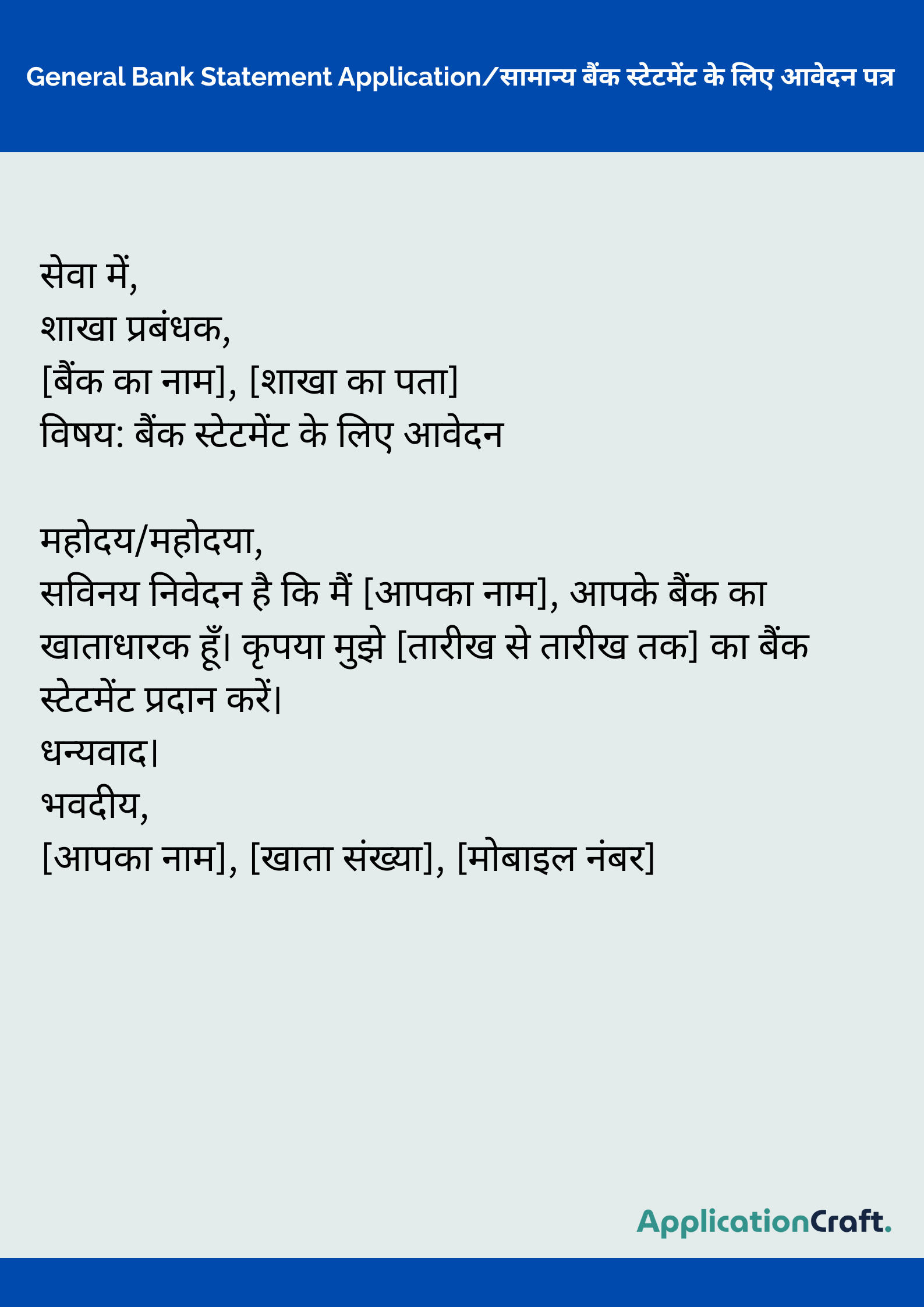

1. General Bank Statement Application/सामान्य बैंक स्टेटमेंट के लिए आवेदन पत्र

This is the most common type, used for general purposes like personal record-keeping.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: बैंक स्टेटमेंट के लिए आवेदन

महोदय/महोदया,

सविनय निवेदन है कि मैं [आपका नाम], आपके बैंक का खाताधारक हूँ। कृपया मुझे [तारीख से तारीख तक] का बैंक स्टेटमेंट प्रदान करें।

धन्यवाद।

भवदीय,

[आपका नाम], [खाता संख्या], [मोबाइल नंबर]

Use this format for obtaining statements for your own records or any non-specific requirement.

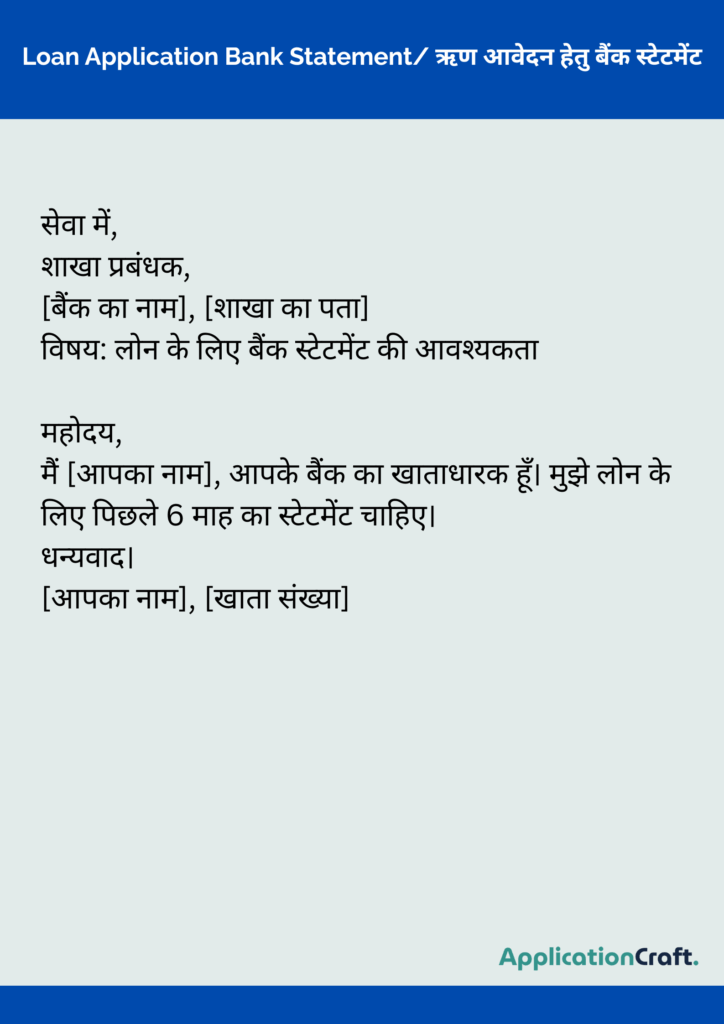

2. Loan Application Bank Statement/ ऋण आवेदन हेतु बैंक स्टेटमेंट

When applying for a loan (home, personal, car, etc.), banks require recent statements.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: लोन के लिए बैंक स्टेटमेंट की आवश्यकता

महोदय,

मैं [आपका नाम], आपके बैंक का खाताधारक हूँ। मुझे लोन के लिए पिछले 6 माह का स्टेटमेंट चाहिए।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Mention the specific loan type and period required for quick processing.

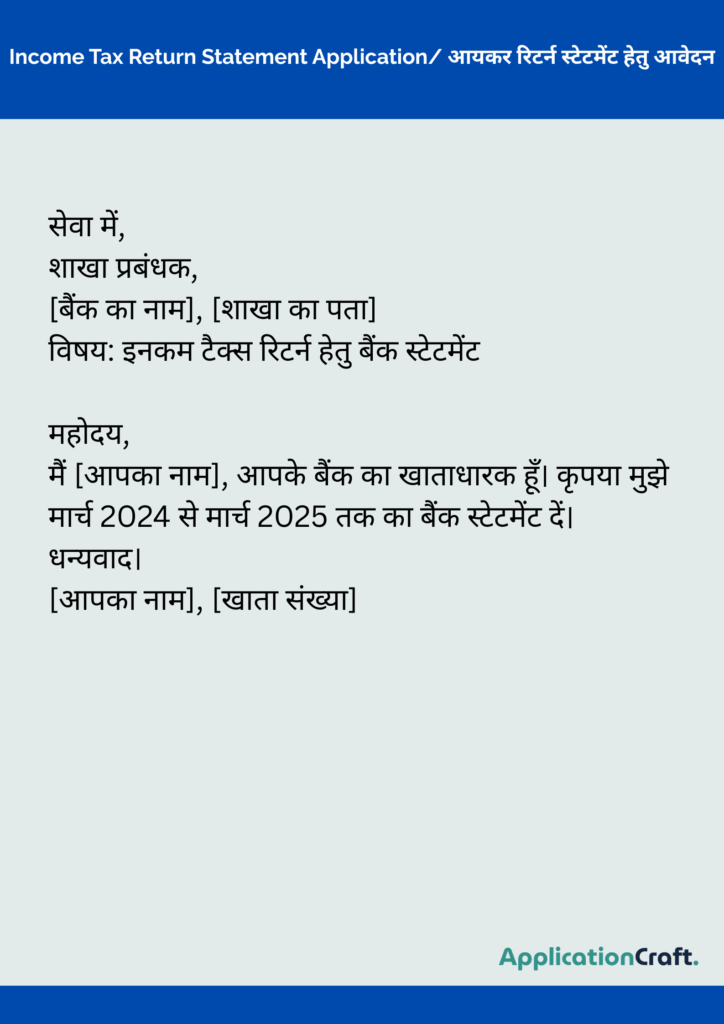

3. Income Tax Return Statement Application/ आयकर रिटर्न स्टेटमेंट हेतु आवेदन

For filing your income tax return, you often need a statement for the previous financial year.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: इनकम टैक्स रिटर्न हेतु बैंक स्टेटमेंट

महोदय,

मैं [आपका नाम], आपके बैंक का खाताधारक हूँ। कृपया मुझे मार्च 2024 से मार्च 2025 तक का बैंक स्टेटमेंट दें।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Always specify the exact financial year for which you need the statement.

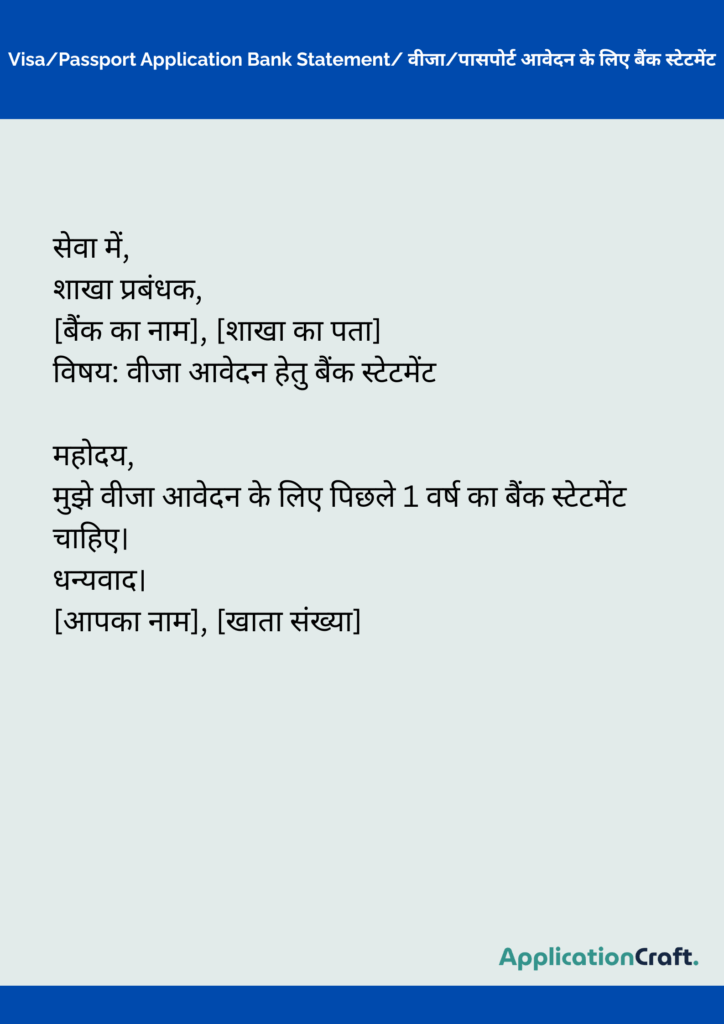

4. Visa/Passport Application Bank Statement/ वीजा/पासपोर्ट आवेदन के लिए बैंक स्टेटमेंट

Visa and passport processes often require proof of funds via bank statements.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: वीजा आवेदन हेतु बैंक स्टेटमेंट

महोदय,

मुझे वीजा आवेदन के लिए पिछले 1 वर्ष का बैंक स्टेटमेंट चाहिए।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Mention the embassy or consulate if needed, for clarity.

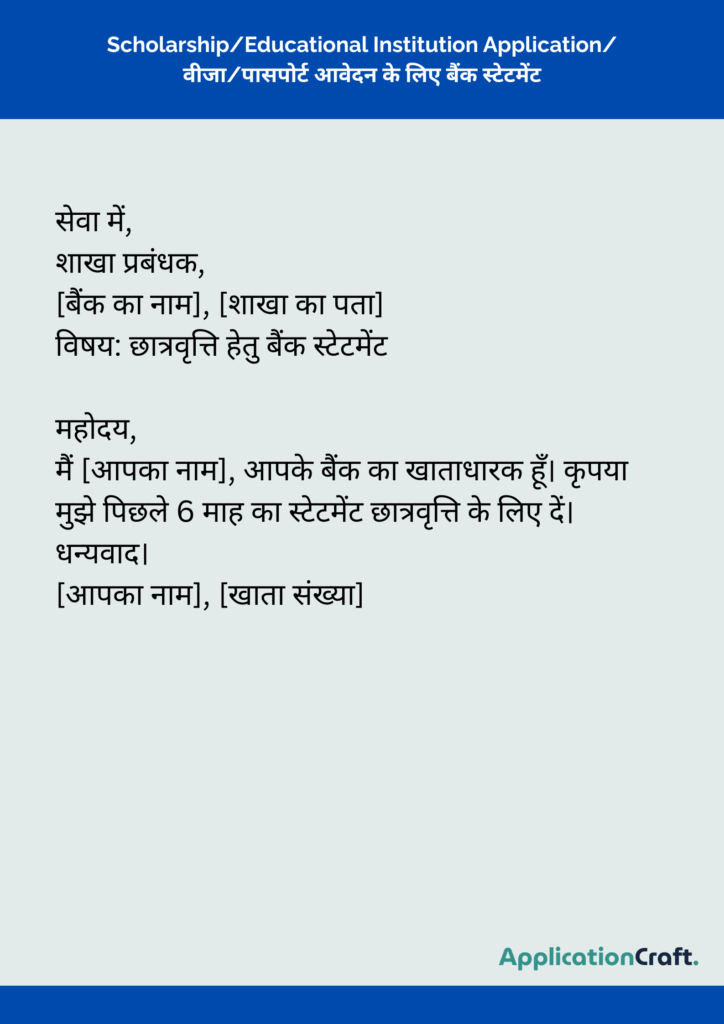

5. Scholarship/Educational Institution Application/ वीजा/पासपोर्ट आवेदन के लिए बैंक स्टेटमेंट

Educational institutions and scholarship providers may ask for recent bank statements.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: छात्रवृत्ति हेतु बैंक स्टेटमेंट

महोदय,

मैं [आपका नाम], आपके बैंक का खाताधारक हूँ। कृपया मुझे पिछले 6 माह का स्टेटमेंट छात्रवृत्ति के लिए दें।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Specify the scholarship or institution for which you’re applying.

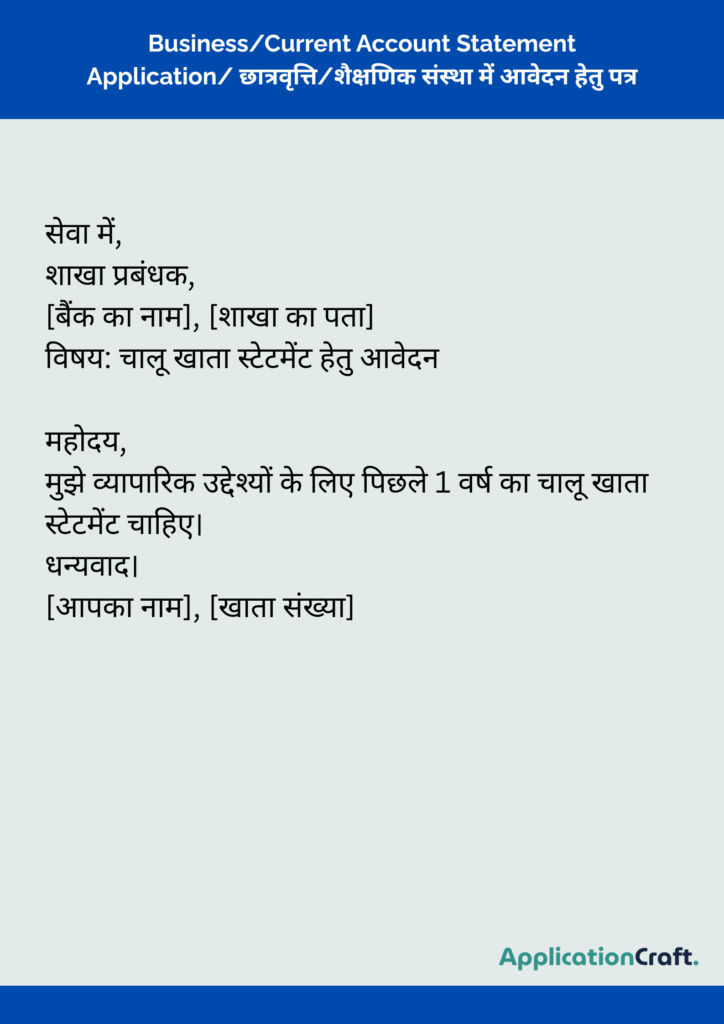

6. Business/Current Account Statement Application/ छात्रवृत्ति/शैक्षणिक संस्था में आवेदन हेतु पत्र

For business or current account holders, statements are often needed for audits or business loans.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: चालू खाता स्टेटमेंट हेतु आवेदन

महोदय,

मुझे व्यापारिक उद्देश्यों के लिए पिछले 1 वर्ष का चालू खाता स्टेटमेंट चाहिए।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Mention your business name and GST number if applicable.

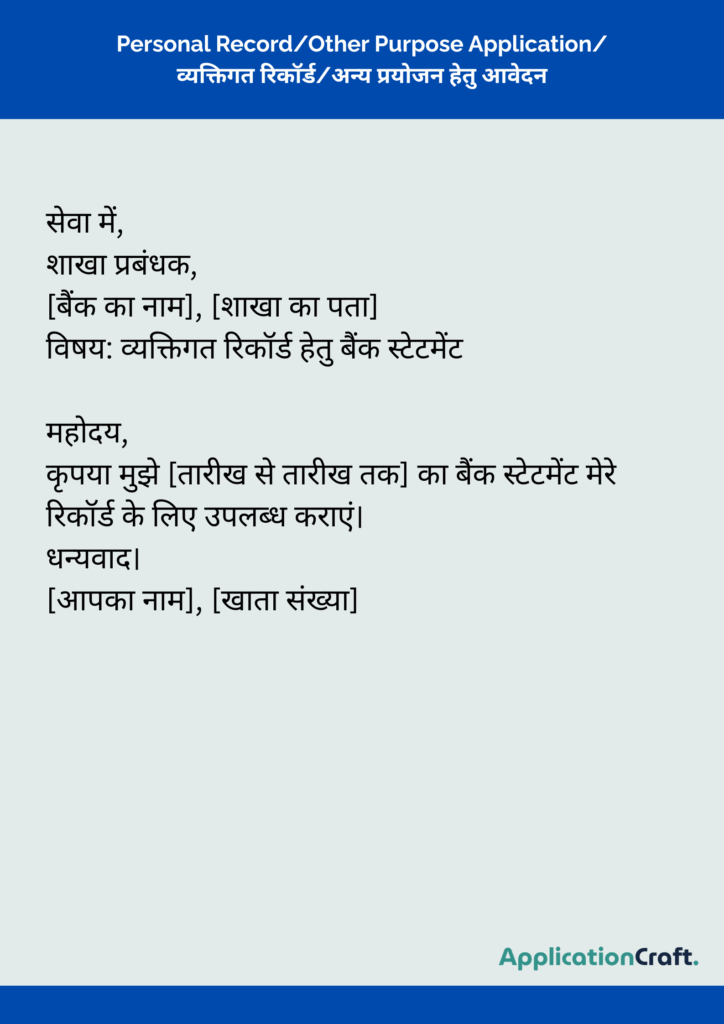

7. Personal Record/Other Purpose Application/ व्यक्तिगत रिकॉर्ड/अन्य प्रयोजन हेतु आवेदन

For any other specific or personal reason, use this flexible format.

सेवा में,

शाखा प्रबंधक,

[बैंक का नाम], [शाखा का पता]

विषय: व्यक्तिगत रिकॉर्ड हेतु बैंक स्टेटमेंट

महोदय,

कृपया मुझे [तारीख से तारीख तक] का बैंक स्टेटमेंट मेरे रिकॉर्ड के लिए उपलब्ध कराएं।

धन्यवाद।

[आपका नाम], [खाता संख्या]

Always clarify your unique reason for transparency.

Tips for Writing an Effective Bank Statement Application

Suggestions for a Clear and Impactful Application

To ensure your application is effective and processed quickly, keep these tips in mind:

- Be specific: Clearly mention the period and reason for the statement.

- Attach necessary documents: Include a copy of your identity proof.

- Use polite language: Always address the manager respectfully.

- Double-check details: Ensure your account number and contact info are correct.

- Sign and date: Never forget to sign and date the application for authenticity.

Common Mistakes to Avoid

- Missing out on account or contact details.

- Not specifying the period required.

- Forgetting to attach ID proof.

- Using informal or unclear language.

- Not signing the application.

Table – Quick Reference: Bank Statement Application Formats

Here’s a handy table summarizing the different types of bank statement applications and their key elements:

| Purpose | Key Details to Mention | Typical Period | Required Documents |

|---|---|---|---|

| Loan Application | Loan type, account details, branch | Last 6 months | ID proof, account details |

| Income Tax Return | Financial year, account details | 1 year | PAN, account details |

| Visa/Passport | Embassy/consulate, account details | 1 year | Passport copy, account details |

| Scholarship/Education | Institution/scholarship, account details | Last 6 months | ID proof, admission letter |

| Business/Current Account | Business name, GST, account details | 1 year | Business proof, account details |

| Personal Record | Reason, account details | As needed | ID proof |

| General Purpose | Reason, account details | As needed | ID proof |

How to Obtain a Bank Statement: Online and Offline Methods

Online Methods

Thanks to digital banking, getting your bank statement is easier than ever. Here’s how you can do it:

- Net Banking: Log in to your bank’s official website (e.g., SBI, HDFC Bank, ICICI Bank) and download your statement from the “Statement” or “e-Documents” section.

- Mobile Banking Apps: Use your bank’s mobile app to access and download your statement in PDF format.

- UPI-Based Apps: Some apps like Google Pay, PhonePe, and Bhim UPI allow you to view or download statements directly.

Offline Methods

If you prefer the traditional way, here’s what you can do:

- Visit the Branch: Go to your bank’s branch and submit your written application.

- ATM: Many banks allow you to print a mini statement from their ATMs.

- Postal Request: Send your application by post to your branch’s address. The statement can be mailed to your registered address.

Frequently Asked Questions

1. Where Should I Submit My Application?

Submit your application at the branch where your account is maintained. If you’re unable to visit, you can send it by post to the branch address.

2. What Documents Are Needed?

Usually, you need:

- A copy of your ID proof (Aadhaar, PAN, Driving License, etc.)

- Your account number and contact details

3. How Long Does It Take to Get a Statement?

- Online: Instantly via net banking or mobile app.

- Offline: Depends on the bank—some issue statements immediately, others may take a day or two.

4. Is There a Fee for Bank Statements?

- Online statements are mostly free.

- Physical copies may incur a nominal fee, depending on the bank and the period requested.

Conclusion

Writing a bank statement application in Hindi is simple if you follow the correct format and provide all necessary details. Whether you’re dealing with State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda, or any other major bank, the process remains largely the same. Always be clear about your requirements, attach supporting documents, and use polite language. With the examples and tips shared above, you can confidently draft your application for any purpose—be it for loans, tax, visas, scholarships, or personal records.

If you found this guide helpful, don’t forget to share it with friends and family who might need it. For more such practical guides on banking and finance, stay tuned to my blog!